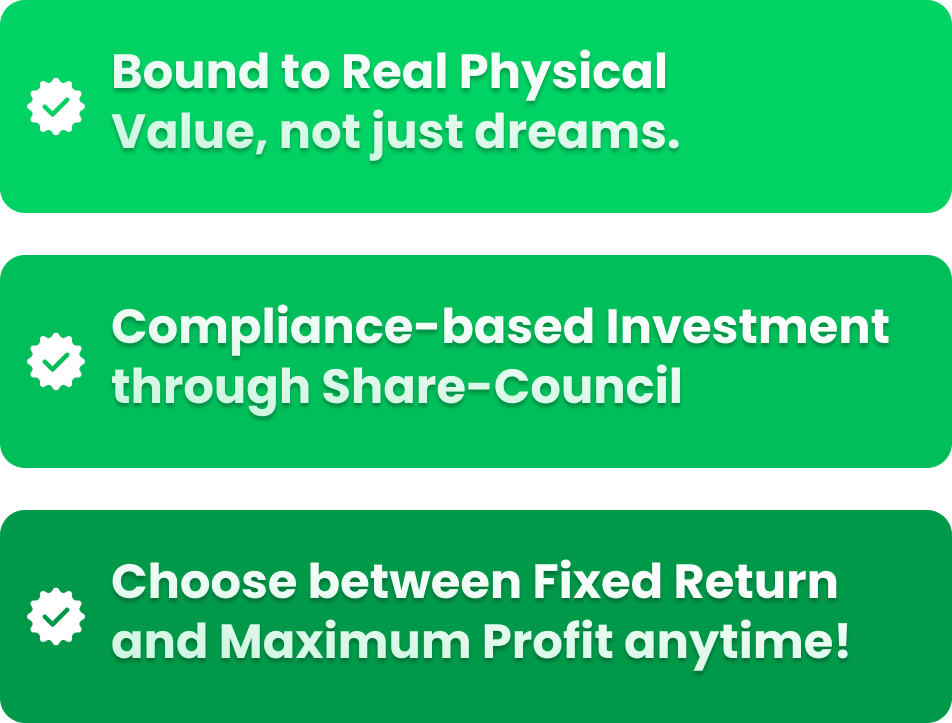

Get a 9% Fixed Annual Return and Beat the Market.

Why take risks when we're confident in the company's growth?

With our Bond, you earn a return each year that exceeds average market growth,

providing a straightforward solution with optimal benefits.

It's a win-win with no compromises. From 100,000€ to 109,000€ in 1 year, no questions asked, and regardless of the company's growth-rate, you will receive your money.

Fix and Flip your Bond for One-Time Stock Hits

During each reevaluation round, you have the option to convert your bond into company stock at a 30% direct discount!

This means that when you notice the company stock increasing significantly, you receive exclusive market rates and can achieve an immediate 30% return on your invested money, benefiting directly from stock trading!

Earn more by thinking less. 9% Fixed. Up to 3% Bonus.

Yes, you read that correctly.

You get a 9% fixed return as planned.

But if we outperform our business plan, you share in the upside:

- +1% bonus if we beat targets by up to 25%

- +2% bonus if we beat targets by up to 50%

- +3% bonus if we exceed targets by more than 50%

When we win big, you win bigger.